Student Loan Updates & Forgiveness: What You Need To Know!

Are you grappling with student loan debt, unsure of your options amidst a maze of regulations and proposed changes? The landscape of federal student loans is undergoing significant shifts, and understanding these changes is crucial to navigating your repayment journey effectively.

The U.S. government has put in place loan forgiveness programs designed to ease the burden of federal student loans. Some of these programs offer a path to debt relief for those working in public service for a defined duration. However, accessing these programs is not automatic. It necessitates proactive engagement, beginning with a thorough understanding of the eligibility criteria, strict deadlines, and the application process. Before making any repayment decisions, it is highly recommended to visit studentaid.gov, the official website for comprehensive information. This will help you understand the specifics of the loan forgiveness programs and any related requirements.

Navigating the complexities of student loan repayment can be daunting. Numerous entities provide customer service to assist borrowers. These services, often offered on behalf of the lender, include answering questions, helping with repayment plan selection, and processing student loan payments. These services are crucial, especially given the dynamic nature of student loan regulations, with constant updates and new rules being implemented.

- Adolfo Angel The Man Who Turned Passion Into Purpose

- Harlee Mcbride The Rising Star Shaping The Future Of Entertainment

The student loan industry is continuously evolving. The goal is to enhance the experience for students and families. This ongoing effort is critical, given the ever-changing economic climate and regulatory environment that affects student loan repayment. This proactive approach is important in addressing challenges and ensuring the best possible outcomes for borrowers.

The government is actively considering adjustments to the federal student loan system. A key focus involves the overhaul of federal student loans. This may encompass stricter borrowing limits. In addition, changes to parent PLUS loans, as well as alterations to repayment rules for loans originated after July 1, 2026, are also under consideration. Borrowers should keep a close eye on these potential shifts. They could significantly influence repayment terms and overall financial strategies.

Proposed modifications also include the potential discontinuation of certain benefits. Economic hardship and unemployment deferments, along with aspects of Public Service Loan Forgiveness (PSLF) eligibility, could be affected. These changes, if implemented, would primarily impact future borrowers. This underscores the need for all borrowers to stay informed about potential changes. Staying informed allows them to adjust their financial plans. This proactive approach is critical to navigating the ever-changing landscape.

- Ziggy Heath The Rising Star Redefining Music And Creativity

- Philip Sternberg The Unparalleled Visionary Redefining Success

On March 25, the White House announced a student loan forgiveness proposal. This initiative is aimed at offering "hardship" relief. This program could provide support for approximately 8 million borrowers facing significant financial challenges. However, the proposal faces hurdles before it can be enacted. It is essential for borrowers to stay informed about the progress and any potential outcomes.

Simultaneously, legislative efforts continue, notably with the introduction of a new reconciliation bill. This bill aims to overhaul the federal student loan framework by establishing more stringent borrowing limits. It also aims to eliminate parent PLUS loans and introduce new repayment rules. These planned adjustments, which would take effect for loans disbursed after July 1, 2026, may alter the repayment options for future borrowers.

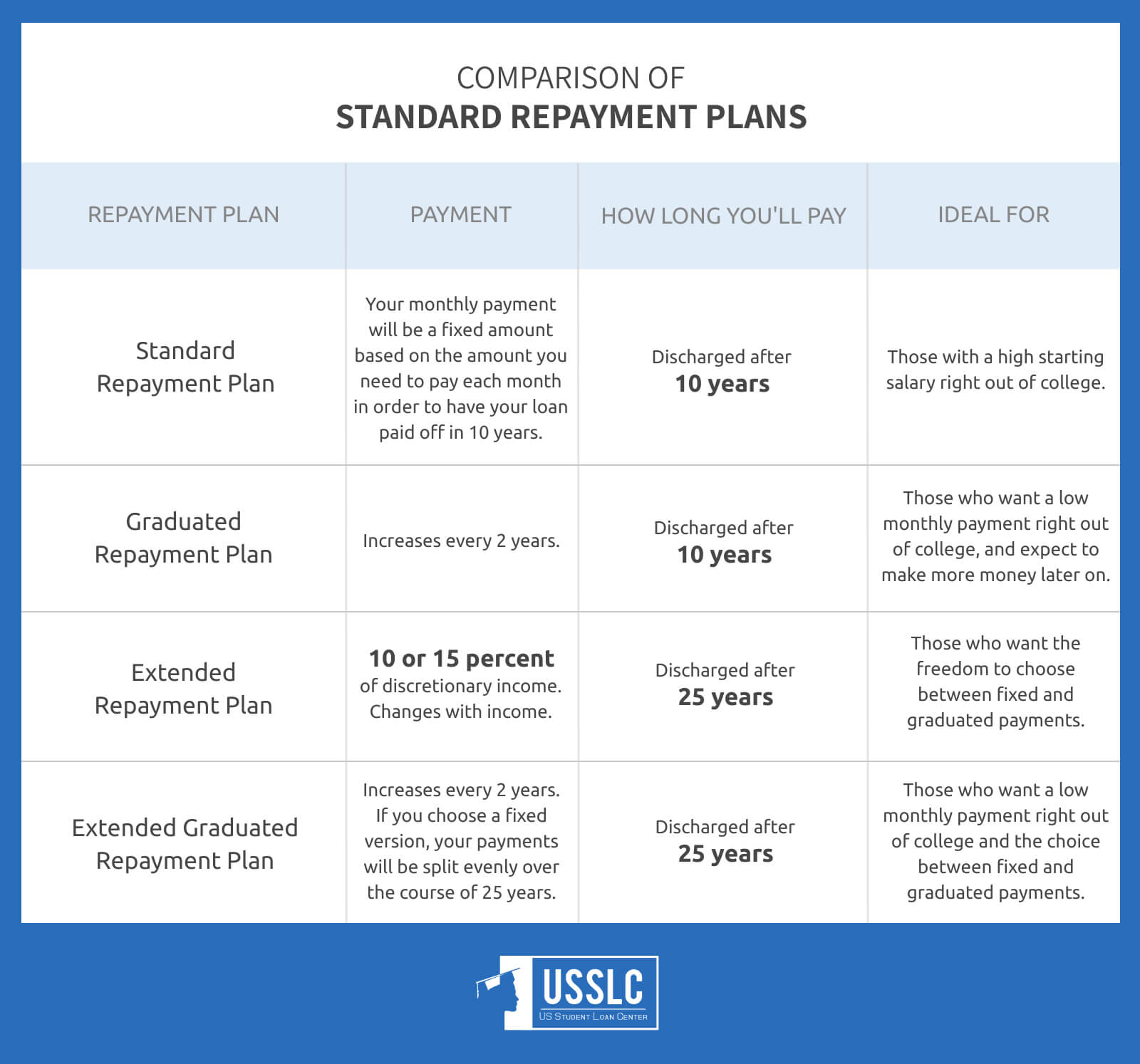

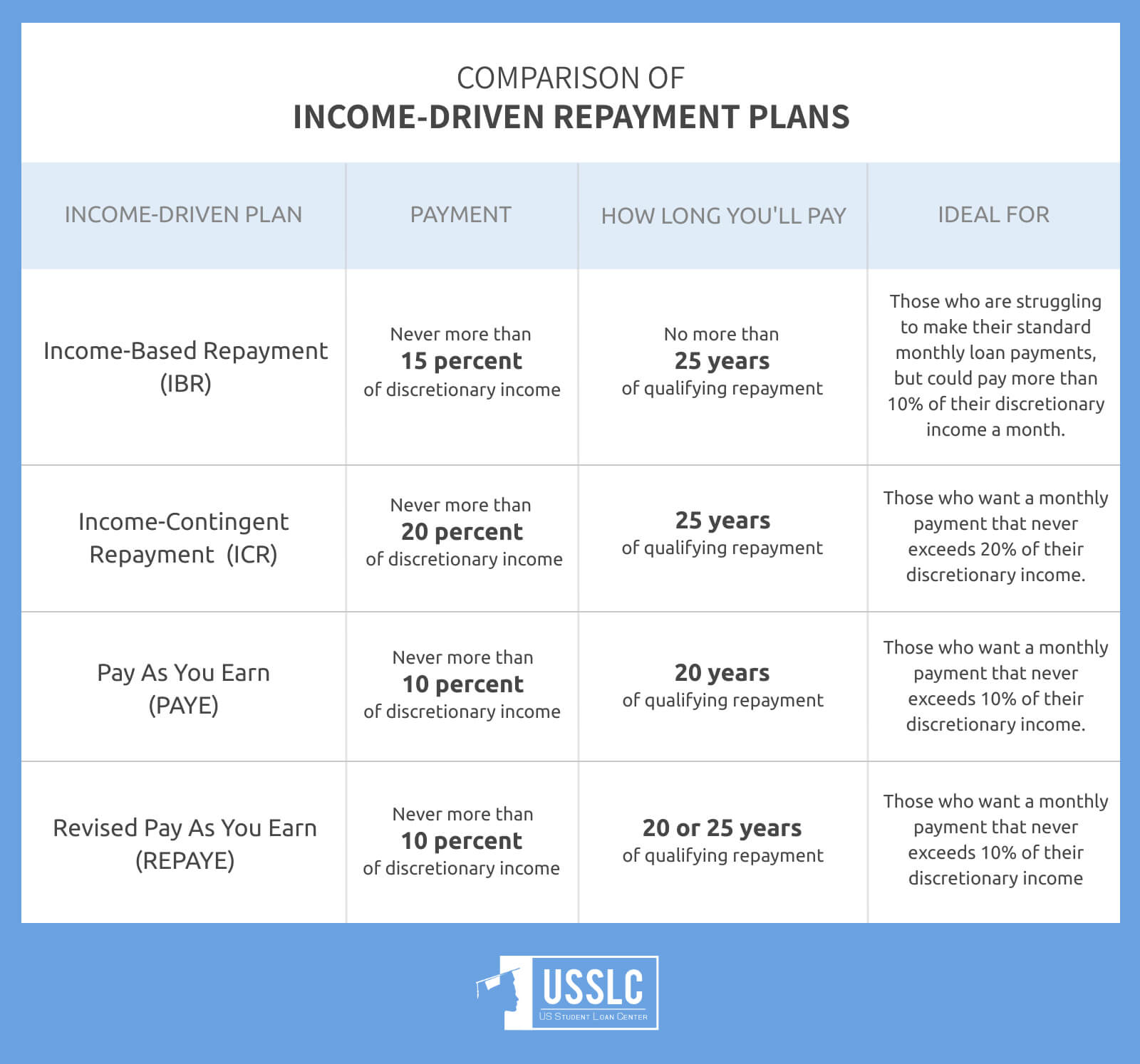

If implemented, the proposed changes to student loan repayment would only affect loans taken out after July 1, 2026. The new standard plan and the new income-driven repayment (IDR) plan are the two main choices for new borrowers. These revisions would set the framework for future student loan repayment. This makes it important to understand the details of each choice.

The GOP is also offering a proposal. It's called the Student Success and Taxpayer Savings Plan. It would provide only two repayment options. This affects those with federal student loans. Borrowers will need to evaluate these plans. They will need to determine which path best suits their financial needs.

Student loans are backed by the American people. It's important to be aware that the U.S. government funds these loans. The decisions about these loans have a wide effect on the economy. Therefore, making good decisions is extremely important.

The scope of student debt is vast. Today, 42.7 million individuals owe over $1.6 trillion in student debt. This massive debt burden has significant implications for both individual borrowers and the broader economy. Proper management of student loans is very important.

There have been court cases and ongoing legal challenges concerning the SAVE plan. Affordable payments and student loan forgiveness, which were part of the SAVE plan, have been blocked by a federal appeals court since last August. This situation is very fluid, and further developments are likely.

Another significant development is the resumption of collections on defaulted federal student loans. These collections, which began on May 5, involve the federal government offsetting funds. This means withholding money from federal or state income tax refunds, Social Security payments, and other federal payments to repay student loans. Borrowers facing default should take immediate action.

Borrowers must prevent delinquency to keep their loans in good standing. This means avoiding being late on payments. To avoid these issues, borrowers should proactively manage their loans. This proactive approach guarantees that they are always in good financial standing.

Specific repayment rules apply depending on the loan's origination date. Those who took out student loans between 1998 and 2012 are governed by Plan 1 repayment rules. These borrowers have specific payment schedules and terms. Its important that they understand these rules to manage their loans efficiently.

Some repayment plans include income thresholds. Students only start repaying their loans when their salary breaches a certain threshold. The threshold is designed to provide flexibility based on the borrower's income. This ensures repayments are affordable.

There are limited Public Service Loan Forgiveness waivers. These are available to borrowers with direct loans. They also include those who have already consolidated into the direct loan program. Borrowers with other federal student loan types can also qualify. They must submit a consolidation application into the direct loan program while the waiver is in effect. This limited waiver provides a crucial opportunity.

Updates regarding spousal income may also impact borrowers. New regulations could potentially require spousal income to be included. This is true even for those who file separately or are separated. Borrowers must be informed of any spousal income. They should consult financial advisors as needed.

Stay informed about ongoing developments in student loan repayment. These updates may affect monthly payments. They can also change overall loan strategies. Borrowers should monitor these updates. They should consult with loan servicers. Staying current guarantees that they have all the details.

Student loan servicers play a vital role in the repayment process. They support borrowers by giving information. They also give assistance with repayment plans. They play a key role in student loan repayment.

Student loan borrowers may soon see updates regarding their loan accounts. Keep an eye on your accounts. Make sure you understand the implications of these updates.

James Bergeron, the Acting Under Secretary, recently released a corrected declaration. It states that servicers will implement updated rules regarding spousal information. Married borrowers who file separate income tax returns will have their spouses' information treated in the specified way. Stay informed of the most current information. Contact the loan servicer for clarifications.

Several companies in the student loan market are known for their refinancing services. SoFi is one of them. They offer services. SoFi offers parent PLUS refinancing and also offer refinancing to residents, fellows, and other programs. This can be helpful for borrowers. It can improve the terms on their loans.

SoFi is also offering discounts. The discounts apply to fixed and variable loans. These discounts include an autopay discount and a SoFi Plus discount. It's important to meet the conditions to get those discounts. Check with SoFi for details.

The Department of Education has announced new rulemaking. These might bring important changes to many federal student loan programs. Stay alert and know how these changes may affect you.

The Department of Education posted an update in a legal proceeding with the American Federation of Teachers. Borrowers should follow the legal proceedings. This helps them fully grasp their rights and choices.

Be cautious. There are many scams that target student loan borrowers. Don't ever pay anyone to help. Don't use credit cards or your home's equity to pay for student loans. Educate yourself. Protect yourself. Learn about these scams, and avoid them.

Keep your eyes open for information. Learn more about ways to avoid these scams and wasting money.

These repayment plans are unique. Each one has different terms and conditions. They must know which plan suits their specific financial circumstances.

| Feature | Details |

|---|---|

| Loan Forgiveness Programs | Available for some federal student loans; Public Service Loan Forgiveness (PSLF) for those in public service. |

| Application Requirements | Borrowers must apply for loan forgiveness. |

| Rules and Deadlines | Strict rules and deadlines apply. |

| Official Website | StudentAid.gov is the official resource. |

| Proposed Changes | Possible overhaul of federal student loans with stricter borrowing limits, changes to parent PLUS loans, and new repayment rules for loans after July 1, 2026. |

| PSLF and Deferments | Economic hardship and unemployment deferments, along with some PSLF eligibility, might end for future borrowers. |

| White House Proposal | "Hardship" student loan forgiveness proposal for 8 million borrowers. |

| Repayment Options (Post-July 1, 2026) | New standard plan and new income-driven repayment (IDR) plan. |

| GOP Proposal | Student Success and Taxpayer Savings Plan with two repayment options. |

| Defaulted Loan Collections | Collections on defaulted federal student loans resumed on May 5, with offsets to federal payments. |

| Repayment Rules (Loans 1998-2012) | Plan 1 repayment rules apply for loans taken out between 1998 and 2012. |

| PSLF Waiver | Limited PSLF waiver available for direct loans and those consolidating into the direct loan program. |

| Spousal Income Rules | New rules may require spousal income to be counted, even for those filing separately or are separated. |

| Refinancing Options | Sofi offers refinancing with various discounts. |

| Scam Prevention | Avoid paying for help with student loans; do not use credit cards or home equity for repayment. |

Article Recommendations

- Amy Van Nostrand The Remarkable Journey Of An Inspiring Figure

- Steven Fanning The Untold Story Of A Man Who Changed The Game

Detail Author:

- Name : Jacquelyn Haag

- Username : lind.elvie

- Email : hill.kory@dickens.biz

- Birthdate : 1983-07-16

- Address : 242 Marvin Mountain Suite 282 East Ottilie, VT 17709

- Phone : 1-661-785-4756

- Company : Rutherford-DuBuque

- Job : Agricultural Equipment Operator

- Bio : Placeat laboriosam quas eum. Nobis dolores et aut velit qui. Voluptatem molestiae vitae quaerat est delectus dolor totam.

Socials

tiktok:

- url : https://tiktok.com/@pourosb

- username : pourosb

- bio : Illo velit qui voluptatem quidem quia vero rerum.

- followers : 6272

- following : 484

linkedin:

- url : https://linkedin.com/in/pouros1992

- username : pouros1992

- bio : Sint quas aut et velit et sint itaque.

- followers : 2063

- following : 2803

twitter:

- url : https://twitter.com/bellpouros

- username : bellpouros

- bio : Nihil velit omnis accusantium reiciendis. Quia sit omnis maxime sed. Eligendi vel rerum voluptatem perspiciatis sed voluptas et voluptate.

- followers : 793

- following : 1109