Exxon Mobil (XOM) Stock: Latest News & Analysis - Is It A Buy?

Is now the right time to consider investing in Exxon Mobil (XOM), despite the recent fluctuations in the energy market? The current trading environment, coupled with Exxon Mobil's strategic moves and financial performance, presents a compelling case for potential investors to re-evaluate the company's stock.

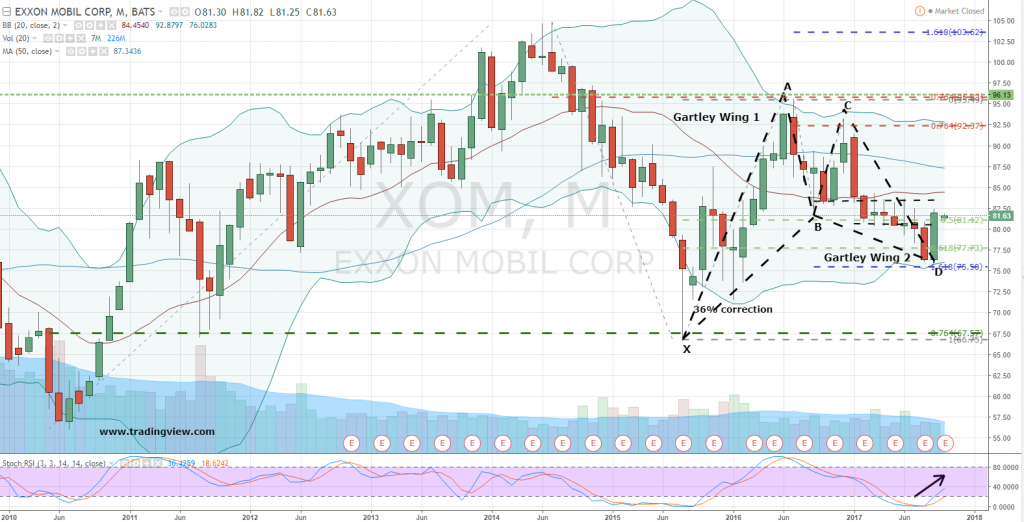

Shares of energy and petroleum stocks are currently navigating a period of downward pressure, a trend that merits closer examination. This situation, compounded by the broader economic landscape, necessitates a deeper dive into the factors influencing Exxon Mobil's (XOM) performance. While the market presents challenges, understanding these dynamics is crucial for making informed investment decisions. One must assess the latest analyst estimates, including earnings and revenue forecasts, earnings per share (EPS) projections, and any recent upgrades or downgrades, to gauge the company's future prospects. Interactive charts, readily available, offer a wealth of data, enabling investors to analyze trends and make informed decisions. Tracking the price, historical values, financial information, and price forecasts is essential to understanding the stock's journey. Furthermore, keeping abreast of news, investor discussions, and expert opinions can provide valuable insights into market sentiment and potential opportunities.

Exxon Mobil's Q4'24 earnings and Free Cash Flow (FCF) were particularly robust, largely driven by the enhanced production capabilities derived from the acquisition of Pioneer Natural Resources. This strategic move underscores the company's commitment to growth and shareholder value. This acquisition also signifies a forward-thinking approach, positioning Exxon Mobil to capitalize on future opportunities in the energy market. The dividend increases are a direct reflection of the company's financial health and its dedication to rewarding shareholders, solidifying its reputation for consistent returns.

- Louise Hobbs The Rising Star Whos Making Waves In The Industry

- Ziggy Heath The Rising Star Redefining Music And Creativity

The information pertaining to the core of the topic is given below:

| Aspect | Details |

|---|---|

| Company Name | Exxon Mobil Corporation (XOM) |

| Industry | Oil and Gas |

| Stock Exchange | NYSE (XOM) |

| Key Metrics | Price, Historical Values, Financial Information, Price Forecast, Earnings, Revenue, EPS, Dividends, etc. |

| Recent Events | Q4'24 Earnings, Pioneer Natural Resources Acquisition, Dividend Increases |

| Market Sentiment | Analysts' Ratings (Buy/Strong Buy), Investor Discussions |

| Challenges & Opportunities | Oil Market Challenges, CO2 Storage Agreements, Growth and Income Strategy |

| Price Information | Trading Price, Price History, Recent Fluctuations |

| Analyst Expectations | Quarterly Earnings Forecasts |

| Shareholder Returns | Dividend Increases, Total Shareholder Returns |

| Trading Resources | Yahoo Finance, MSN Money, Nasdaq, WSJ |

| Additional Details | Oil market challenges, co2 storage agreements and growth and income strategy. |

Reference: ExxonMobil Official Website

The market's current valuation of Exxon Mobil appears to reflect the positive outcomes of its growth and income strategy. This strategy, which encompasses strategic acquisitions, operational efficiencies, and a focus on shareholder returns, is designed to drive long-term value creation.

- Linsey Dawn Mckenzie The Rising Star Whos Taking Hollywood By Storm

- Steve Connors The Unsung Hero Of Modern Innovation

The stock's performance since the start of the year, when it was trading at $107.57, and its recent movement to $106.20, representing a 1.3% decrease, highlight the dynamic nature of the market and the factors impacting Exxon Mobil's valuation. Investors and analysts closely monitor these fluctuations, as they can signal potential buying opportunities or areas of concern. The recent trading session's close at $108.63, a +0.06% increase from the previous day, showcases the day-to-day volatility.

The oil and gas sector, while historically undervalued, is on the cusp of significant developments. Despite short-term hurdles, the long-term prospects remain promising, particularly for well-positioned companies like Exxon Mobil. Recent challenges in the oil market and considerations regarding CO2 storage agreements present both challenges and opportunities. The company's ability to navigate these complex issues will be crucial in determining its future success.

It is important to note that whenever XOM experiences a decline of up to 5%, investors tend to show an increased appetite for the stock, viewing it as a buying opportunity. The historical trends can suggest a level of resilience and investor confidence in the company's long-term prospects. The analysts' expectation for quarterly earnings of $1.70 provides a useful benchmark for evaluating the company's financial health and progress.

The companys continuous focus on rewarding shareholders with dividend increases is a significant factor. This action strengthens the companys attractiveness for long-term investors. The commitment to returns is a sign of financial stability and management confidence.

The latest information on XOM stock is available through various sources, including financial news outlets, investor forums, and company filings. These resources offer access to the latest quotes, historical data, news, and other crucial information needed for trading and investment decisions. Accessing information from reputable sources ensures investors have access to the most up-to-date insights.

The energy market is dynamic. Stay informed about the ongoing developments and strategic moves of Exxon Mobil to make informed investment decisions. The company's adaptation and resilience in the face of market dynamics will determine its long-term value. It is essential to analyze the company's performance metrics, evaluate the broader market context, and use all available resources.

The strategic focus on growth, income, and shareholder returns, combined with its resilience in the face of market challenges, positions Exxon Mobil as a key player in the energy sector. This combination warrants a thorough examination for anyone considering an investment in the energy market. For more detailed investment decisions, its essential to continue to review financial information and analyst recommendations.

Article Recommendations

- Ariadna Gutieacuterrez The Queen Of Beauty And Beyond

- Melissa Sagemiller The Rising Star In Hollywoodrsquos Sky

Detail Author:

- Name : Angie Gulgowski

- Username : qbarrows

- Email : adah.mayer@yahoo.com

- Birthdate : 1997-05-01

- Address : 69737 Schumm Hill Apt. 107 South Armandstad, MO 25147

- Phone : 530-257-1147

- Company : Kohler, Jenkins and Purdy

- Job : Software Engineer

- Bio : Omnis quo mollitia fuga odio. Molestiae ex natus expedita consequuntur debitis recusandae. Fuga aut deleniti labore alias.

Socials

linkedin:

- url : https://linkedin.com/in/stephon4945

- username : stephon4945

- bio : Et sit quia qui odio quam voluptatem est quae.

- followers : 5959

- following : 2596

tiktok:

- url : https://tiktok.com/@stephon.ferry

- username : stephon.ferry

- bio : Est ipsum quaerat ut.

- followers : 2243

- following : 896

twitter:

- url : https://twitter.com/stephonferry

- username : stephonferry

- bio : Et architecto pariatur vitae rerum. Est eum magni voluptatem doloribus dignissimos. Cumque doloribus id rem eum architecto nulla consectetur.

- followers : 1011

- following : 1566

facebook:

- url : https://facebook.com/stephon_real

- username : stephon_real

- bio : Ipsa qui ratione ut tempore nulla est omnis.

- followers : 4900

- following : 2738